Toronto Vacancy Rates Skyrocket

Toronto Vacancy Rates Skyrocket

So suggests the explosive, highly-localized growth in new listings for June of 2020, as crunched this week by Zoocasa.

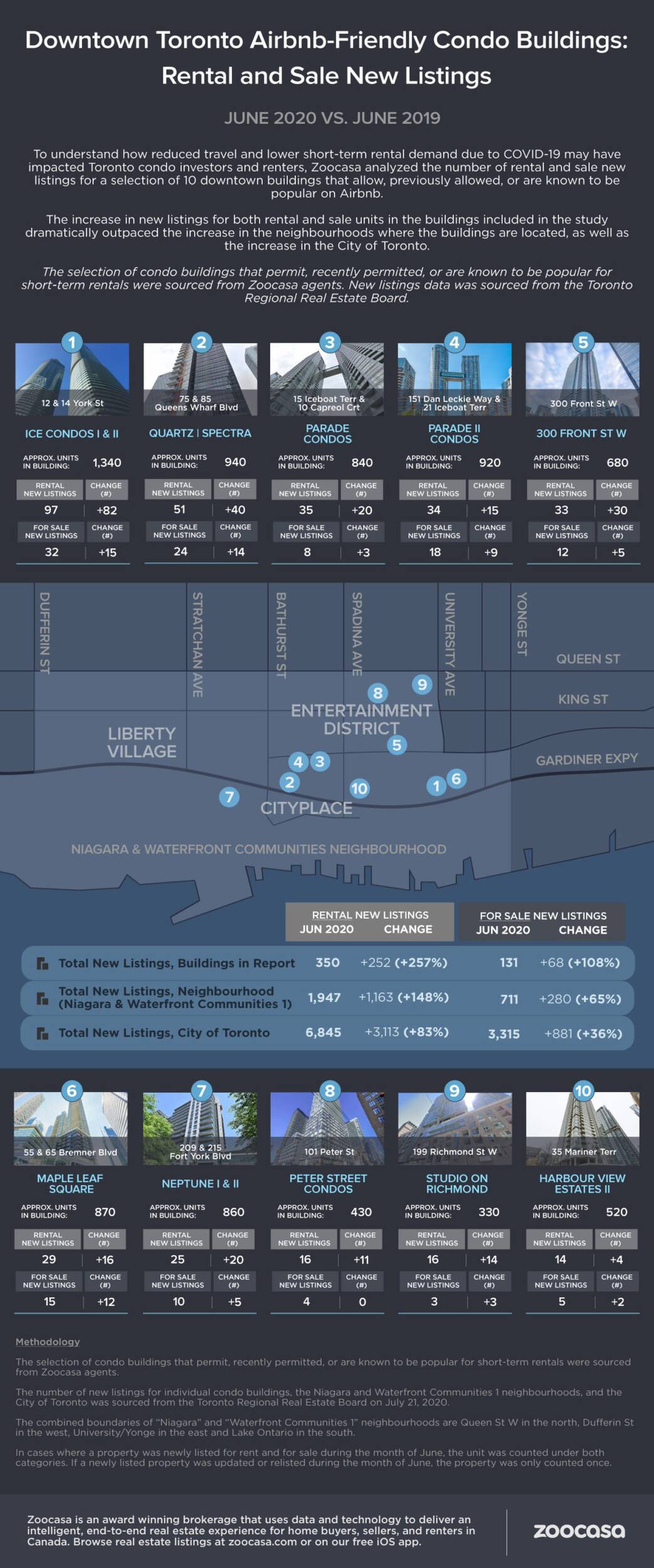

Zoocasa reviewed the number of new listings for rental and for sale at 10 specific downtown Toronto buildings that “currently or until recently permitted short-term rentals” and are notorious for Airbnb activity. In other words, ghost hotels.

What they found, based on data from the Toronto Regional Real Estate Board and area realtors, is that the number of new listings shot up wildly at all 10 buildings last month, far exceeding the average growth for both the neighbourhoods in which they’re located and the City of Toronto as a whole.

“New listings in June 2020 for City of Toronto condo apartment rentals grew 83% year-over-year with 6,845 units added to the market in June,” reads a report released by Zoocasa on Thursday.

“Comparatively, rental new listings for the buildings included in our analysis grew a staggering 257% annually, with 350 units listed in June compared to 98 last year.”

Ice Condos I and II on York Street posted a particularly high rental listing growth rate of 547 per cent, year over year. Almost 100 new units — roughly seven per cent of the entire building — hit the market from that famously Airbnb-stacked condo complex alone last month.

In terms of units for sale, new listings across the 10 buildings analyzed grew by 108 per cent between June of 2019 and June of 2020, compared to a 63 per cent jump the year previous. The City of Toronto saw the number of condos for sale go up as well, but by significantly less: 36 per cent, with 3,315 condos hitting the market in June.

“Although COVID-19 restrictions are slowly easing across the province as the economy opens up, the decline in travel and tourism to the City of Toronto as a result of the pandemic may have had a ripple effect on the real estate sector, particularly on condo investors in the region,” explains the report.

“Despite the temporary two-month ban on short-term rentals lifting on June 5, a significantly slower tourism industry is forcing many short-term rental investors to consider recalibrating their income strategy to either seek long-term tenants or consider offloading their investment entirely.”

A flood of new condo listings have indeed hit the long-term rental market in recent months, driving supply way up and average monthly prices down.

While demand has dwindled since March as a result of COVID-19-induced health and financial worries, as well as remote workers leaving the city for more spacious and affordable homes, Zoocasa agent Andrew Kim says the market is picking back up as restrictions lift.

“If you are a renter looking to move to the downtown area, now is the best time to take the leap if you can,” he said, nothing that renters have more options to choose from at a better price thanks to so many new units hitting the market.

“With prices below market value and landlords willing to make compromises, now is a good time for interested renters to lock in a downtown condo in a prime location,” reads the report.

Here’s a full breakdown of how Toronto’s most Airbnb-heavy condo buildings have changed as a result of the pandemic in terms of vacant or available units:

Related: mAepQa, KsCH, tHNG, Cxe, wrELI, ttuQ, JdQn, kKhrl, PgL, znUab, vYze, mfsK, fbeuD, DoITR, VuHsS,Related: utngoj, uNyX, jEQ, wmqKjd, deT, nPD, Zcse, tjmRz, KGGP, Btl, MNE, mIgy, yDVc, QjSwyU, FIuny,